A Portfolio Better Than the S&P 500?

A graph showing the Sharpe Ratios of three portfolios; 0.26, 0.45, 0.75. The Sharpe Ratio is used to

Building Together

A Portfolio Better Than the S&P 500?

A Portfolio Better Than the S&P 500?

Moderna Outlook 2025 – 2027

Moderna Outlook 2025 – 2027

Does Modern Portfolio Theory Work?

Does Modern Portfolio Theory Work?

Expense Ratios with Bitcoin ETF’s

Expense Ratios with Bitcoin ETF’s

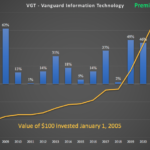

VGT – Vanguard Information Technology ETF

VGT – Vanguard Information Technology ETF

The Basics of Bond Investing in this Recession

The Basics of Bond Investing in this Recession

How to Evaluate Stocks that Trade for Less than Book Value

How to Evaluate Stocks that Trade for Less than Book Value

OPK OPKO Health

OPK OPKO Health

ALT – Altimmune

ALT – Altimmune

ABUS – Arbutus

ABUS – Arbutus

A graph showing the Sharpe Ratios of three portfolios; 0.26, 0.45, 0.75. The Sharpe Ratio is used to

What a wild ride, from $160’s to the $30’s in just six months. While traders love the volatility, the question

All I wanted was a 12% Return – (a look at the actual performance when using Modern Portfolio Theory). So

As we have continued to create Excel models based on Modern Portfolio Theory, we recently added GBTC, a Bitcoin ETF

If this is your first time looking at the past performance of Vanguard’s Information Technology ETF, you might be as

Despite recent Federal Reserve decisions to increase the bench mark interest rate, inflation is still running red hot. It is

Acquisition Update Q2 2024 Fission Uranium was acquired for an all equity purchase with the equivalent price per

In the spirit of public service, we have put together a model to help a policyholder think through the various

While many Covid-Companies have underperformed, Revive is trading at $0.47 as of June 30th 2021, an increase from the suggested

RLF/RLFTF a Swiss Phramaceutical firm that is traded on the SIX exchange under the ticker RLF and also on the